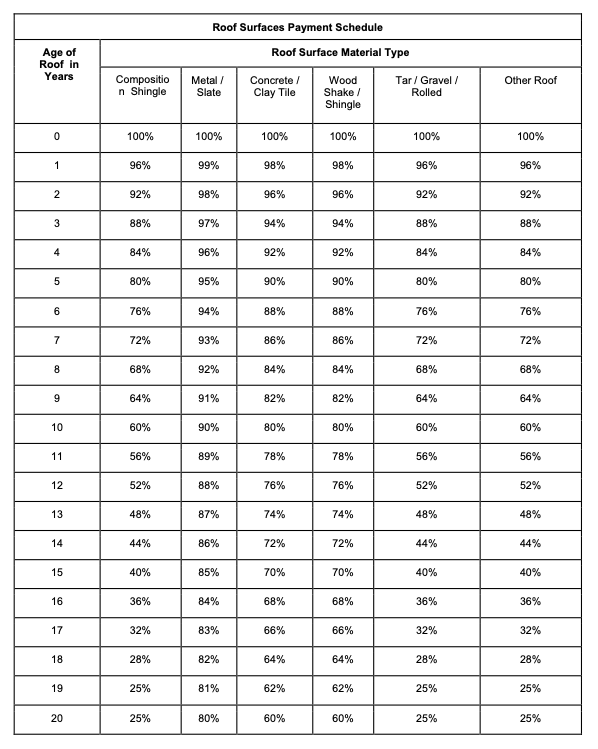

A “Roof Surfaces Payment Schedule” in a property insurance policy is a policy endorsement offered by some insurance companies that alters the way roof damage claims are calculated and paid. Florida Senate Bill SB76 expressly permitted insurance carries to offer policies containing this endorsement. Instead of providing a full replacement cost for a damaged roof, this schedule adjusts the settlement amount based on the age and type of roofing material (see the example payment schedule below). For instance, the payout for a new roof might be near 100% of its cost, but this percentage decreases as the roof gets older. This means for older roofs, the insurance will pay a smaller portion of the replacement cost, often leaving the policyholder with a significant gap in coverage. For a better understanding, lets take a look at a couple different case studies demonstrating how this would impact an insurance claim for roof damage.

Case Study 1: Standard Deductible Scenario Imagine a 15-year-old shingle roof requiring a full replacement costing $35,000. Under the schedule, the insurance payout for a 15-year-old shingle roof might be reduced to 40% of the replacement cost, amounting to $14,000. However, if your policy has an “all other perils” deductible of $2,500, this amount is subtracted from the insurance payment. The actual amount you receive is $11,500, leaving you with a $23,500 out-of-pocket expense.

Case Study 2: Hurricane Deductible Scenario Now, consider the same 15-year-old shingle roof damaged by a hurricane. The policy’s Hurricane Deductible, calculated at 5% of the Coverage A limit ($325,000), amounts to $16,250. Applying the same Roof Surfaces Payment Schedule, the insurance would owe $14,000. After the hurricane deductible, the payout becomes negative, meaning you’re responsible for the full replacement cost of $35,000 and the high hurricane deductible.

These case studies highlight the importance of understanding the implications of such endorsements on potential claims. For policyholders, it’s vital to be aware of these details to prepare adequately for financial responsibilities in the event of roof damage.

Entire Cost of Replacement or Just Cost of Materials?

After examining the case studies, it’s important to delve into a critical aspect of the “Roof Surfaces Payment Schedule Endorsement.” This concerns potential ambiguity in the language of the endorsement regarding the application of the payment schedule percentage. Specifically, there is a question as to whether this percentage should be applied to the entire cost of the roof replacement – including materials, labor, permits, fees, taxes, debris hauling, etc. – or only to the cost of the actual roofing materials necessary for the replacement, like shingles, underlayment, flashing, tar, nails, etc.

If the payment schedule percentage applies only to the roofing materials and not the entire replacement cost, this could significantly increase the amount owed under the policy. For instance, the labor costs, which can be a substantial portion of the total roof replacement cost, along with other associated expenses, would be excluded from the reduced payment calculation. This would lead to a higher reimbursement from the insurance company, reducing the financial burden on the policyholder. Understanding and clarifying this ambiguity is crucial for policyholders seeking to maximize their claim payout.

Additional ambiguity surrounding the “Roof Surfaces Payment Schedule Endorsement,” could arise in a very common scenario where the damage to the roof allows water to enter the property, causing interior damage. This scenario necessitates the involvement of a general contractor, as a roofing specialist alone may not be licensed to perform interior repairs. Typically, contractors are allowed to add reasonable overhead and profit charges to the job cost, usually around 10% each. This raises a legal question: does the payment schedule percentage apply to the cost of the roof replacement inclusive or exclusive of these overhead and profit charges? The resolution of this issue could significantly impact the total reimbursement from the insurance company, affecting the financial responsibility of the policyholder. Understanding and addressing this legal nuance is crucial for ensuring appropriate claim settlement.

A “Roof Surfaces Payment Schedule” in a property insurance policy is an endorsement that alters the way roof damage claims are calculated and paid. Instead of providing a full replacement cost for a damaged roof, this schedule adjusts the settlement amount based on the age and type of roofing material (see the example payment schedule below). For instance, the payout for a new roof might be near 100% of its cost, but this percentage decreases as the roof gets older. This means for older roofs, the insurance will pay a smaller portion of the replacement cost, often leaving the policyholder with a significant gap in coverage. For a better understanding, lets take a look at a couple different case studies demonstrating how this would impact an insurance claim for roof damage.

Case Study 1: Standard Deductible Scenario Imagine a 15-year-old shingle roof requiring a full replacement costing $35,000. Under the schedule, the insurance payout for a 15-year-old shingle roof might be reduced to 40% of the replacement cost, amounting to $14,000. However, if your policy has an “all other perils” deductible of $2,500, this amount is subtracted from the insurance payment. The actual amount you receive is $11,500, leaving you with a $23,500 out-of-pocket expense.

Case Study 2: Hurricane Deductible Scenario Now, consider the same 15-year-old shingle roof damaged by a hurricane. The policy’s Hurricane Deductible, calculated at 5% of the Coverage A limit ($325,000), amounts to $16,250. Applying the same Roof Surfaces Payment Schedule, the insurance would owe $14,000. After the hurricane deductible, the payout becomes negative, meaning you’re responsible for the full replacement cost of $35,000 and the high hurricane deductible.

These case studies highlight the importance of understanding the implications of such endorsements on potential claims. For policyholders, it’s vital to be aware of these details to prepare adequately for financial responsibilities in the event of roof damage.

Entire Cost of Replacement or Just Cost of Materials?

After examining the case studies, it’s important to delve into a critical aspect of the “Roof Surfaces Payment Schedule Endorsement.” This concerns potential ambiguity in the language of the endorsement regarding the application of the payment schedule percentage. Specifically, there is a question as to whether this percentage should be applied to the entire cost of the roof replacement – including materials, labor, permits, fees, taxes, debris hauling, etc. – or only to the cost of the actual roofing materials necessary for the replacement, like shingles, underlayment, flashing, tar, nails, etc.

If the payment schedule percentage applies only to the roofing materials and not the entire replacement cost, this could significantly increase the amount owed under the policy. For instance, the labor costs, which can be a substantial portion of the total roof replacement cost, along with other associated expenses, would be excluded from the reduced payment calculation. This would lead to a higher reimbursement from the insurance company, reducing the financial burden on the policyholder. An interesting observation is that this potential issue also arises when calculating appropriate depreciation when determining the correct Actual Cash Value (ACV) payment amount. Understanding and clarifying this ambiguity is crucial for policyholders seeking to maximize their claim payout.

General Contractor Overhead & Profit?

Additional ambiguity surrounding the “Roof Surfaces Payment Schedule Endorsement,” could arise in a very common scenario where the damage to the roof allows water to enter the property, causing interior damage. This scenario necessitates the involvement of a general contractor, as a roofing specialist alone may not be licensed to perform interior repairs. Typically, contractors are allowed to add reasonable overhead and profit charges to the job cost, usually around 10% each. This raises a legal question: does the payment schedule percentage apply to the cost of the roof replacement inclusive or exclusive of these overhead and profit charges? The resolution of this issue could significantly impact the total reimbursement from the insurance company, affecting the financial responsibility of the policyholder. Understanding and addressing this legal nuance is crucial for ensuring appropriate claim settlement.

If you’re facing challenges with your property insurance claim, especially in understanding or contesting a “Roof Surfaces Payment Schedule,” don’t navigate these complex waters alone. Contact the experienced attorneys at Property Claims Attorneys, PLLC for a free consultation. Our team is skilled in handling a range of property insurance disputes and is ready to assist you. Contact Us now to get the expert advice and representation you need to ensure your rights are protected and you receive the compensation you deserve.